How A Stock Market Works

Compare top https://en.forexbrokerslist.site/ brokers side-by-side, complete with objective reviews from the Nerds. Get stock recommendations, portfolio guidance, and more from The Motley Fool’s premium services. Market makers buy and hold shares and continually list buy-and-sell quotations for shares.

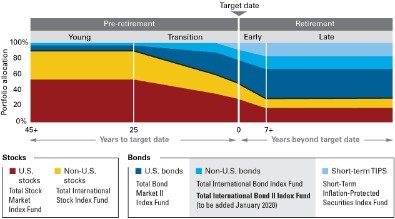

It also means investments that are spread among different industries – since stock in similar sectors may move in a similar direction for the same reason. One of the key advantages of an index fund is that you immediately have a range of stocks in the fund. For example, if you own a broadly diversified fund based on the S&P 500, you’ll own stocks in hundreds of companies across many different industries.

The stock market—where buyers and sellers can trade shares of public companies—is one of 4 financial markets, along with the bond market, commodities market, and derivatives market. Over time, the stock market has offered one of the most powerful opportunities for investors to grow wealth. There are entire books dedicated to explaining how the stock market works, but if you’re looking for the basics, we’ve got you covered here. Financial innovation has brought many new financial instruments whose pay-offs or values depend on the prices of stocks. Some examples are exchange-traded funds , stock index and stock options, equity swaps, single-stock futures, and stock index futures.

Stock market index

Last-sale reporting is the submission of details about the quantity and price of a stock trade to Nasdaq within 90 seconds of the trade’s close. Stock markets create efficient price discovery and efficient dealing. Stocks can be classified into many different types, such as small-cap, mid-cap, and large-cap stocks, international and domestic stocks, and growth and value stocks. Stocks are a kind of financial instruments that gives the owner a fractional share of the issuing company. The Office of Attorney General does not make any promises, assurances, or guarantees as to the accuracy of the translations provided.

- Assuming all your new shops were just as profitable as the first one, you would pay them $400,000.

- We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site.

- Indirect participation in the form of retirement accounts rose from 39.3% in 1992 to 52.6% in 2007, with the median value of these accounts more than doubling from $22,000 to $45,000 in that time.

- These regulations aim to protect investors and maintain fair and efficient markets.

- These systems can match buyers and sellers far more efficiently and rapidly, resulting in significant benefits such as lower trading costs and faster trade execution.

In a nutshell, a broker is simply an entity licensed to trade stocks on a stock exchange. A broker may be an actual person whom you tell what to buy and sell. More commonly, it is an online stock broker — say, TD Ameritrade or Fidelity — that processes the entire transaction electronically. Stocks represent an ownership interest in businesses that choose to have their shares available to public investors.

Other Types of Markets

Also, don’t put too much faith in past performance because it’s no guarantee of the future. Stock markets are volatile and can fluctuate significantly in response to company, industry, political, regulatory, market, or economic developments. Investing in stock involves risks, including the loss of principal. FINRA also regulates those in the financial services industry who work in the markets.

Public Trends shows stock performance over time, helping investors understand long-term movements in stock prices. If a company is just getting started or wants to expand, they can raise money without going into debt by offering to sell pieces of ownership in the company to the general public. Those pieces of ownership are called stocks , and companies can list shares of their stock on stock exchanges where investors can buy them. Price-Earnings ratios as a predictor of twenty-year returns based upon the plot by Robert Shiller (Figure 10.1). The vertical axis shows the geometric average real annual return on investing in the S&P Composite Stock Price Index, reinvesting dividends, and selling twenty years later. Data from different twenty-year periods is color-coded as shown in the key.

Mutual funds employ professional managers to make decisions about what to buy and sell. A potential buyer places an order with a broker for the stock he or she wishes to purchase. The broker then puts in the order to buy on the appropriate exchange, the transaction takes place when someone wants to sell and someone wants to purchase the stock at the same price.

With help from a https://topforexnews.org/ advisor you can trust, you can get a better handle on the stock market and start investing for your future. For example, you now have a say in how the business is run, you’ll get a small cut of the company’s profits , and your shares become more valuable as the company grows over time. Misconceptions about the stock market—like thinking you don’t have enough money to start investing—stop some folks from investing for their future. Others are afraid of a stock market crash, and that fear keeps them on the sidelines. And some people just don’t get how the stock market works at all, so they stay away. Companies, that would otherwise be unavailable or inconvenient to trade, do trade in the U.S. markets as ADRs (receipts for shares of the foreign stock issued by U.S. banks).

Please refer to your financial advisor or tax professional for advice. A bull market and a bear market are terms used to describe the general market trends. A bull market is a period during which stock prices are generally rising. A bear market is a period when stock prices are generally falling.

Many businesses decide offer shares in what’s known as an Initial Public Offering in order to raise capital. In addition to gaining money, offering stocks also allows companies to use stock options to attract and retain top talent, gain exposure with the public, and win the attention of additional investors. Equity research analysts may be employed by stock brokerage firms, mutual fund companies, hedge funds, or investment banks. These are individuals who research publicly-traded companies and attempt to forecast whether a company’s stock is likely to rise or fall in price.

Value investing is more focused on avoiding risk than growth investing is, although value investors do seek to buy stocks when they consider the stock price to be an undervalued bargain. OTC stocks are not subject to the same public reporting regulations as stocks listed on exchanges, so it is not as easy for investors to obtain reliable information on the companies issuing such stocks. Stocks in the OTC market are typically much more thinly traded than exchange-traded stocks, which means that investors often must deal with large spreads between bid and ask prices for an OTC stock. In contrast, exchange-traded stocks are much more liquid, with relatively small bid-ask spreads. OTC stocks are stocks that do not meet the minimum price or other requirements for being listed on exchanges. Stock markets provide a secure and regulated environment where market participants can transact in shares and other eligible financial instruments with confidence, with zero to low operational risk.

Investment strategies

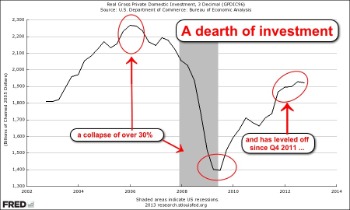

For example, if people fear that prices will go down, they may start selling their securities. But if many people sell large numbers of securities, they can actually make prices go down. If widespread selling continues, a stock market crash can happen. A crash means that the prices have fallen so low that very few people are willing to buy securities.

https://forex-trend.net/ in stocks can be a key part of your personal finance strategy. The primary reason most people buy stocks is to generate a long-term return on their investment that exceeds that of other prominent asset classes, such as bonds, real estate and commodities. While investing in the stock market may be a good idea for many, investing in individual stocks may not, especially for the novice investor. Smart stock picking requires in-depth research and plenty of dedication. And building a well-diversified portfolio out of single stocks can be like a full-time job.

And that’s where interested investors can then buy a stake in the now publicly traded business, and the company can get an influx of cash to invest back into its business. Investment is usually made with an investment strategy in mind. The secondary purpose the stock market serves is to give investors – those who purchase stocks – the opportunity to share in the profits of publicly-traded companies. The other way investors can profit from buying stocks is by selling their stock for a profit if the stock price increases from their purchase price.

The S&P 500 is a market-cap-weighted index of the 500 largest companies in the U.S. and is a much more valid indicator.

What is a Stock?

With a short-term investment and a hard deadline, there’s a greater chance you’ll need that money back before the market has had time to recover losses. Investors purchase those shares, which allows the company to raise money to grow its business. Investors can then buy and sell these stocks among themselves. Investment often depends on an individual’s tolerance for risk.

Buyers are expecting their stocks to rise, while sellers may be expecting their stocks to fall or at least not rise much more. Understanding whether you’re investing for the long-term future or the short term can also help determine your strategy – and whether you should be investing at all. Sometimes short-term investors can have unrealistic expectations about growing their money. And research shows that most short-term investors, such as day traders, lose money. You’re competing against high-powered investors and well-programmed computers that may better understand the market. The function of the stock market relies on investors and brokers, handling stocks, and stock exchanges.